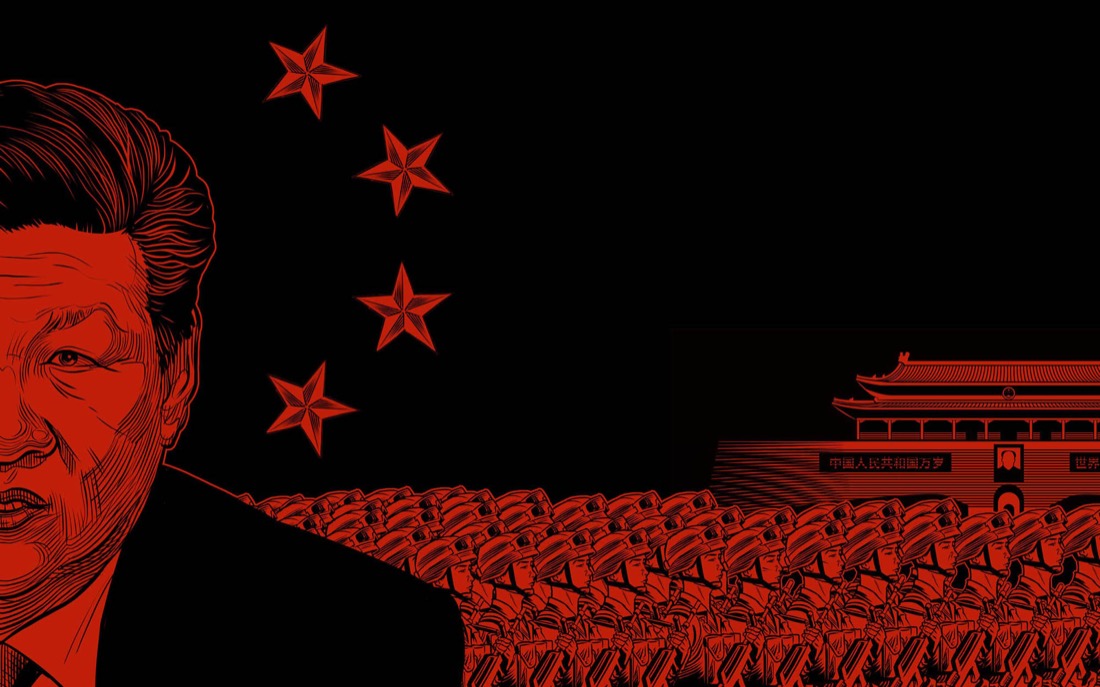

On-chain data shows Tether movements hitting a new all-time-high for 2Q19 with one month left on the calendar for the period. What is most striking, however, is the volume coming in and out of Chinese exchanges dwarfs western and global trading venues and accounts for more than half of the total transaction value of known parties.

Data provided to Diar by blockchain analysis firm Chainalysis highlights the magnitude of Chinese Tether demand with over $16Bn received by exchanges based in that market in 2018. This year the number has already surpassed an outstanding $10Bn, setting the stage for the biggest year yet.

2019 to date flows into exchanges catering primarily for Chinese traders beat the $7Bn of all the transactional value for 2017.

Tether on-chain movements stateside account for a tiny 3% of known volumes at $450Mn, more than $10Bn less than flows sent and received by Chinese exchanges.

And the demand is on the rise. In the 2018 bear market, Chinese exchanges accounted for 39% of all known on-chain transaction value for Tether. This year to date, the red dragon is responsible for a whopping 60%.

Global exchanges like Binance and Bitfinex have a share equivalent to half that at 31%, dropping from the 47% share seen for both 2017 and 2018.

US-based exchanges saw their share of the stablecoin demand/trading drop from 44% in 2017 to less than 10% in 2018.

This isn’t a matter of cashing out. The stablecoin movements on-chain are just shy of netting out between sent and received funds, indicating a cyclical nature and trading desire across all exchanges. The on/off nature is likely due to custody reasons from potential exchange hack concerns (see chart 3).

This similar character in the net balance of sent and received funds globally and across all regions suggests legitimate flows. There is no disparity or alternative behavior in the movement of Tethers sent to Chinese exchanges versus the transactions sent to regulated US-based trading venues.

On-chain movements out of China are telling and in stark contrast to what the industry now perceives as nothing more than fake volume following an extensive report by Bitwise, an asset management firm that filed for a Bitcoin Exchange Traded Fund (ETF) with the US Securities and Exchange Commission (SEC).

Bitwise, which looked into 83 exchanges, found a mere 10 to be compliant across its own tests. And there are clear examples of dubious trading volumes that resemble simple algorithms filling up order books that fall far from reputable exchange trading trends.

On-Chain transactional volume in 2019 has gone up in unison with reported trading volumes.

While it may not be comparing apples to apples, it’s not comparing apples to oranges either. Massive amounts of funds are being moved into exchanges in China for no other purpose than trading. Even a single trade of Tethers moved onto Chinese exchanges would equal daily volumes equivalent to $215Mn for the month of April (the period Bitwise analyzed), which is three times as much as Coinbase and on par with Binance (see chart 5). This does not even take into account funds sitting on the exchanges.

The similarities in percentages of reported trading volume versus Tethers moved on and off exchanges is certainly not proof-of-innocence (POI) nor vindicating of potential wash trading and fake volumes.

But in consideration of the billions in Tethers moved on-chain in China that towers over US and world market transactional value, the estimate by Bitwise of 95% of cryptocurrency trading volume being fake is also likely to be far off the mark, possibly by magnitudes.