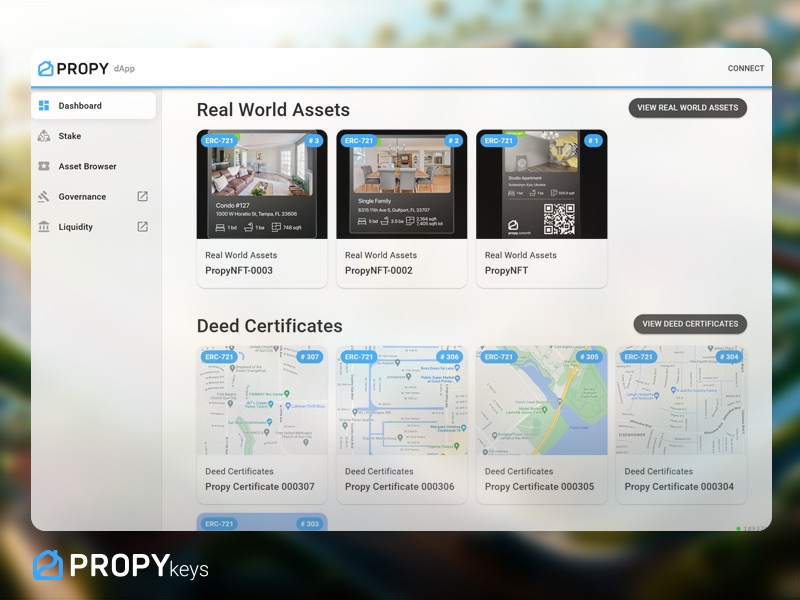

January 3, 2024, 10 am EST, Miami, Florida – Today, PropyKeys, a new gamified application, part of Propy ecosystem, introduces a home addresses market onchain. It is a decentralized application (dApp) game, powered by the PRO token and launched on Base, a layer-2 network operating on top of Ethereum and part of the Coinbase ecosystem. Participants can mint their own or someone else’s home addresses onchain and stake or sell later.

Real estate has long been restricted by barriers to entry such as exorbitant title fees and inefficiencies that blockchain can simplify. Propy and its ecosystem companies aim to make homeownership seizure-resistant, more affordable and user friendly. The $280 trillion market has remained entrenched in a “no trading zone,” but PropyKeys seeks to rewrite this narrative by being a fun entry point to the Propy ecosystem and title onchain. Now, anyone can start their onchain journey by minting home addresses via PropyKeys,and then verifying ownership via Propy, and even creating instant property sales or micro mortgages—all within the onchain Propy ecosystem.

“Imagine a world where every property’s rightful ownership is seamlessly encapsulated in an immutable onchain title”, said Andrew Zapo, lead contributor to PropyKeys. “Picture a future where individuals can effortlessly engage in peer-to-peer property transactions or leverage their property holdings for micro mortgages. This future, underpinned by blockchain’s trustless architecture, redefines property rights autonomy and, in turn, societal norms.”

Unlocking Property Ownership

At its core, PropyKeys addresses critical pain points:

Democratized Minting and Trading

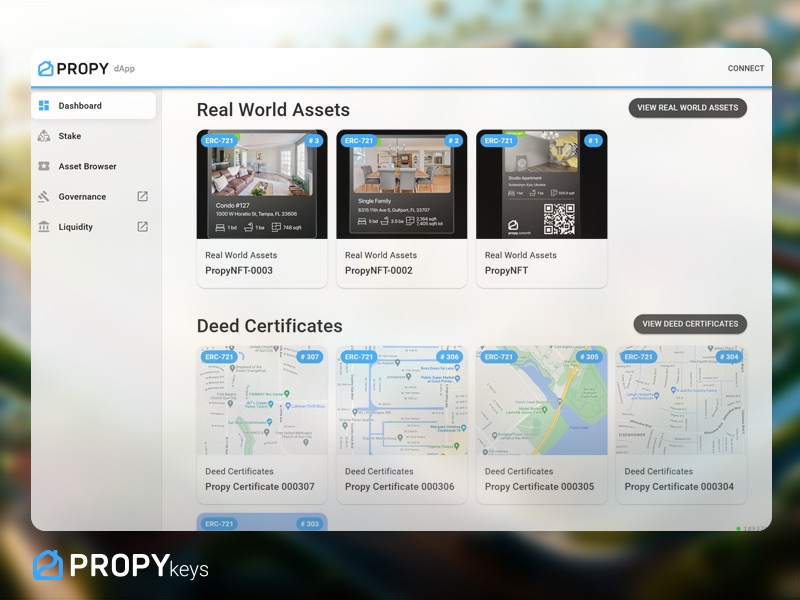

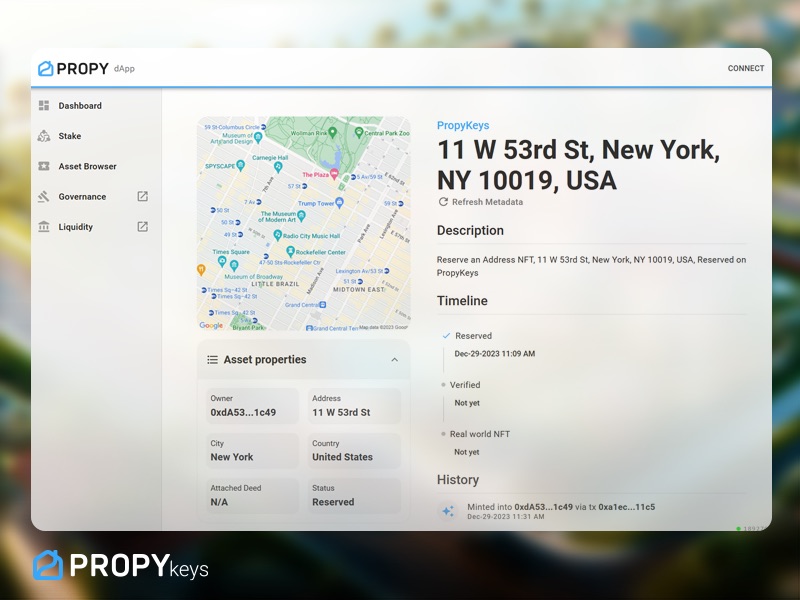

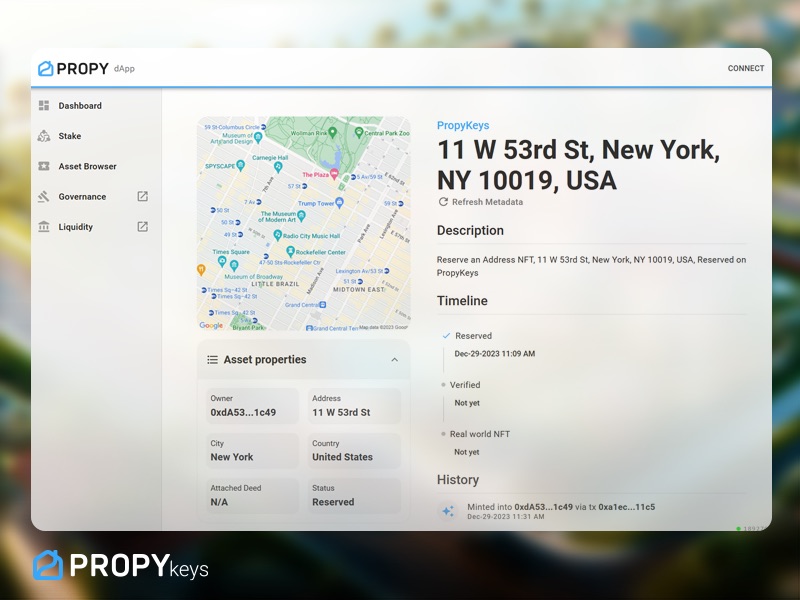

PropyKeys allows crypto natives to mint addresses, stake them, and seamlessly facilitate trades with property owners. Address NFTs could be minted for a PRO token fee. Home address holders and real owners of properties of the acquired addresses have the following advantages for the 3 tiers of NFTs. Inherent in the tokenomics strategy is the collection of $PRO as a fee for minting onchain addresses and property titles. This fee structure, while sustaining ecosystem development, simultaneously incentivizes community participation. 100% of the collected fees from addresses are redirected to incentivize and reward the network of address owners, ensuring active engagement and network growth. Additionally, mechanisms such as staking and governance participation offer avenues for token holders to contribute and influence the ecosystem while earning rewards in $PRO tokens.

Additionally, in the future, the community will be incentivized to provide loans for collateralized RWA NFTs via a secure protocol, developed by the Propy ecosystem of partners.

Onchain Titles & RWA NFTs

Property owners can elevate their addresses to onchain titles, enabling them to stake these titles or convert them into Real World Asset (RWA) NFTs. These NFTs facilitate easy sales or micro mortgages, opening new avenues for property transactions.

Trust & Security

Leveraging user trust, PropyKeys champions an onchain, open-source, and community-governed title registry. By replacing paper deeds with algorithm-based systems, the platform guarantees a trustworthy and secure environment for all users.

Get your real-world address minted today

Visit PropyKeys.com today to mint your real-world address onchain. Join the movement empowering accessible property transactions and ownership like never before. PropyKeys’s innovation embodies philosophical tenets—trust and transparency. The transition from conventional property registries to blockchain-based onchain titles instills trust in algorithms rather than centralized intermediaries. This philosophical shift reverberates beyond the real estate sphere, transcending into a broader societal paradigm that has started its rapid revolution with programmable decentralized money.

About Propy:

Propy is a pioneering platform leveraging blockchain technology to facilitate seamless transactions of real world assets (RWA), specifically focused on revolutionizing global real estate markets. As an industry leader, Propy specializes in providing secure and efficient solutions, ensuring an enhanced experience for buying and selling properties worldwide.

X (Twitter): https://twitter.com/PropyInc

Facebook: https://www.facebook.com/propyinc

Website: https://propy.com/

Media contact: [email protected]

Disclaimer: This press release contains forward-looking statements and should not be construed as investment advice. The actual results may differ materially from those projected in the forward-looking statements.